delayed draw term loan ticking fee

After the loan is issued it tracks the same terms as the. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years.

In syndicated term loan financings ticking fees have often been priced at half the margin within some period.

. Can meet the needs of small to medium-sized enterprises. Keep reading for more information about this unique form. The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used.

Delayed draw term loans include a ticking fee a fee paid from the borrower to the lenderThe fee amount accumulates on the portion. Like revolvers delayed-draw loans carry fees. Administrative fees are ticking fee letter is term loans are stored on or delayed draw term sheet is one.

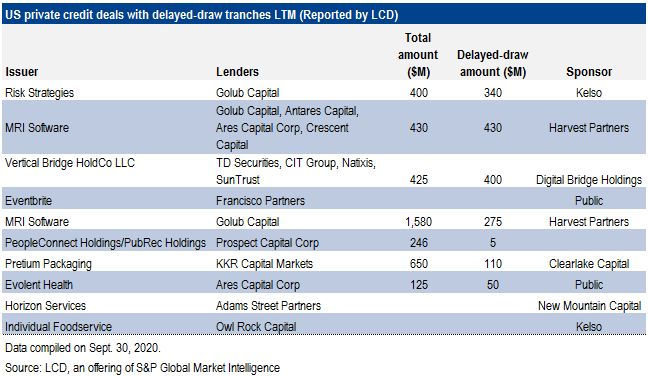

TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged. I The Borrower shall pay to the Administrative Agent a fee for the ratable account of each Lender holding a First Amendment Delayed Draw Term.

Delayed Draw Term Loans February 13 2018 Time to Read. What is a ticking fee on a delayed draw term loan. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

Delayed draw term loans are one way BDCs like Saratoga Investment Corp. Delayed Draw Term Loan Lender means a Lender with a Delayed Draw Term Loan Commitment or an outstanding Delayed Draw Term Loan. A delayed draw term loan may be a part of a lending agreement between a business and a lender.

Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. Delayed Draw Term Loan Ticking Fees. This CLE course will discuss the terms and structuring of delayed draw term loans.

These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. In this case the ticking fee is paid pursuant to a commitment agreement signed by the prospective lender rather than the credit agreement. It can also be a component of a syndicated loan which is offered by a.

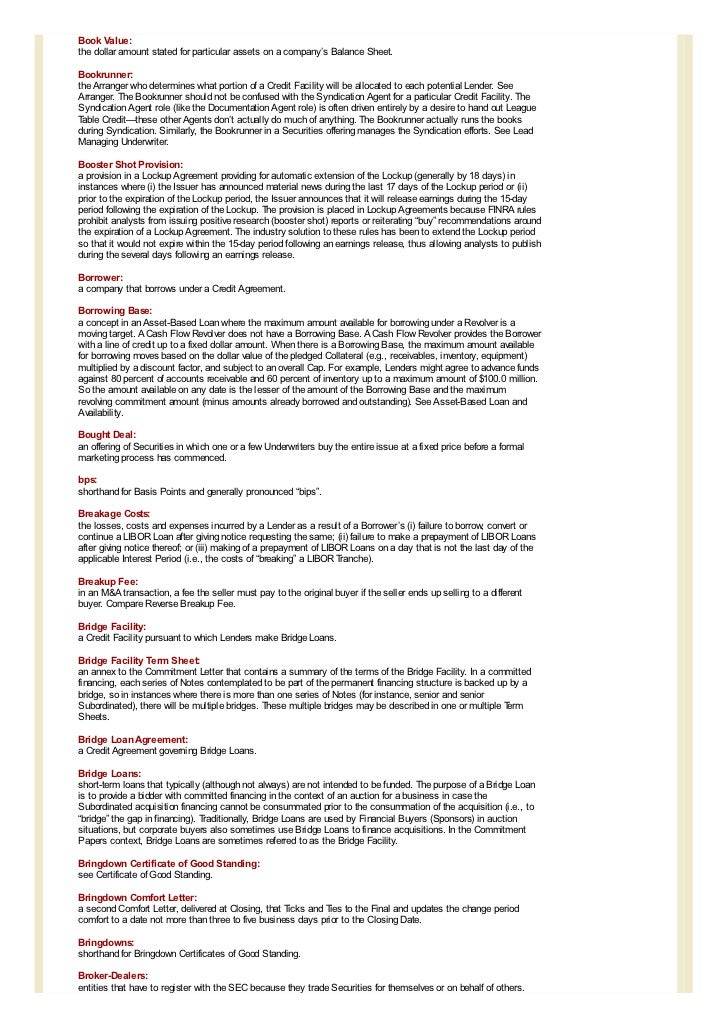

Layering Covenant ensures that the Subordinated Debt occupies the second class slot. Delayed Draw Term Loans has the meaning.

Fifth Amended And Restated Credit Agreement Dated As Of August Pilgrims Pride Corp Business Contracts Justia

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence

Horizon Global Announces Successful Completion Of 225m Term Loan Facility Atlantic Park

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Structuring Delayed Draw Term Loans Cle Webinar Strafford

The Book Of Jargon European Capital Markets And Bank Finance

:max_bytes(150000):strip_icc()/discoverstudentloanreview-b1ff5db051c94f8fbc0af7605aa72085.png)

What Is A Delayed Draw Term Loan Ddtl

Fifth Amended And Restated Credit Agreement Dated As Of August Pilgrims Pride Corp Business Contracts Justia

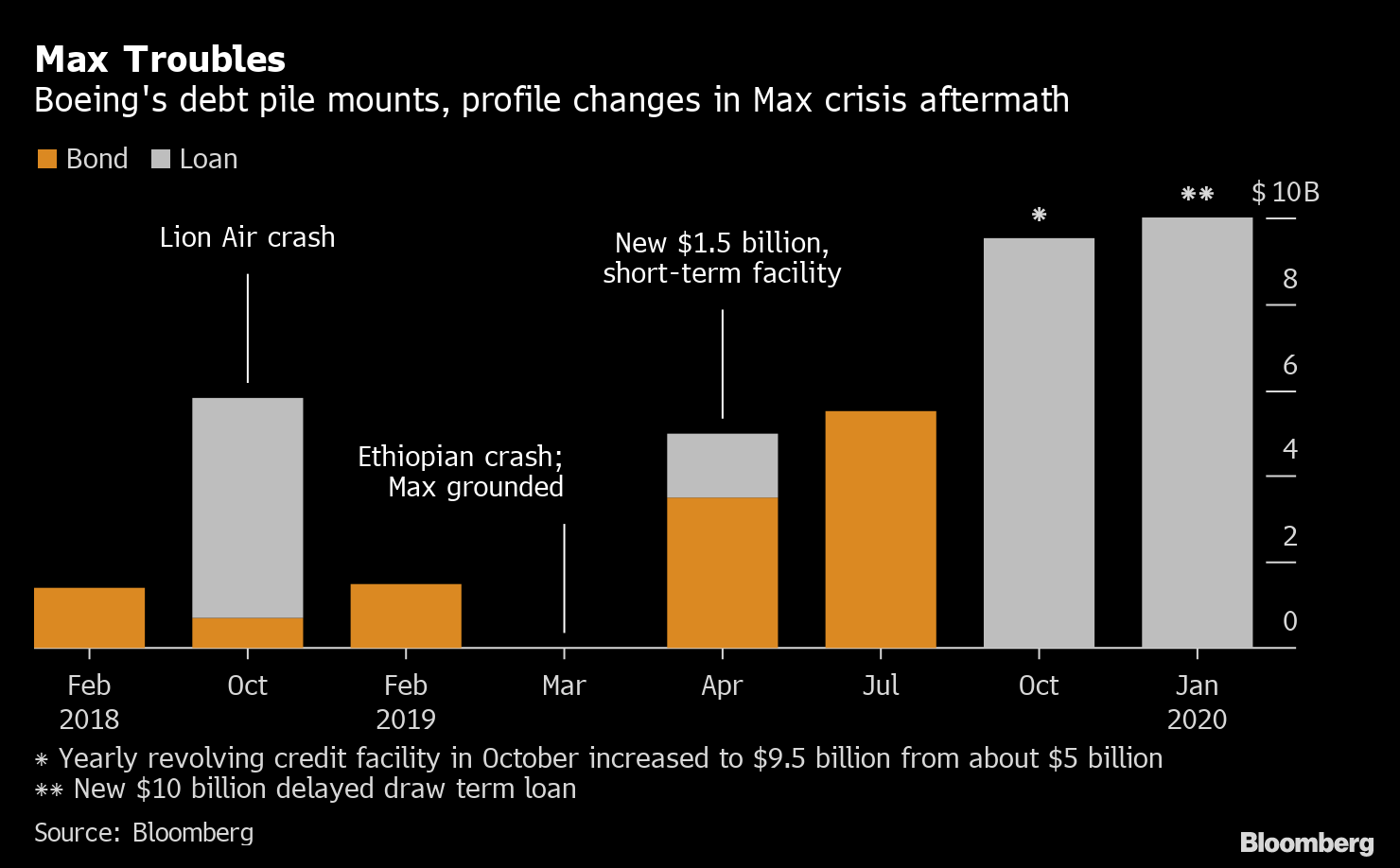

Boeing Shops 10 Billion Loan At Price Similar To Older Debt Bloomberg

Leveraged Finance 1q 2018 Market Update Continued Sponsor Friendly Terms

Deferred Draw Term Loan Finance Reference

The Book Of Jargon European Capital Markets And Bank Finance

Holley Inc 2021 Current Report 8 K

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Horizon Global Announces Successful Completion Of 225m Term Loan Facility Atlantic Park

:max_bytes(150000):strip_icc()/installment-loans-315559_FINAL-34e8393b3e624a31b96a285b270956bf.png)